Russian Art Shopping / Hermitage Magazine Summer 2008 # 2 (11)

Ivan Lindsay is a private art dealer in European and Russian paintings and has established world record prices for many artists including Goya, Canaletto and Hobbema. He is also a publisher and writer and writes for the magazines Country House, Millionaire, Spears Wealth Management Survey and the Art Book Journal.

The indispensability of Russia’s vast reserves of natural resources for western consumers is creating huge fortunes. Some of this excess capital is driving an already overheated western art market and helping to establish the fledgling russian art market. Despite the credit crunch, the subprime debacle, the banking crisis and the dollar’s slide, the art market remains strong because it follows a year behind the rest of the economy.

As asset prices deflate, art becomes a refuge. The art market will cool off in due course and will not reignite until the next economic boom is well underway. During this period prices will remain stable for the best paintings by the Old Masters, Impressionists and early 20th century painters, and leading Russian painters of the 19th and 20th century. However, the area that will see the biggest decline is the Contemporary market. It is worth remembering that only ten artists from any decade stand the test of time and yet there are at least 100 contemporary artists currently be ing proclaimed as great masters.

That the Russians are rapidly discovering their passion for art will come as no surprise to anyone familiar with pre-Soviet Russian history. Catherine famously bought the collection of Britain’s first Prime Minister, Sir Robert Walpole of Houghton Hall, en bloc, and caused a major international fall out between Britain and Russia. The old aristocratic families of Russia such as the Demidovs, Vorontsovs, Sheremetevs and Yussopovs filled their palaces in Moscow and St. Petersburg with treasure as did the mercantile collectors, Pavel Tretyakov, Sergei Schukin and Ivan Morozov, the last two being early and important patrons of Picasso and Matisse.

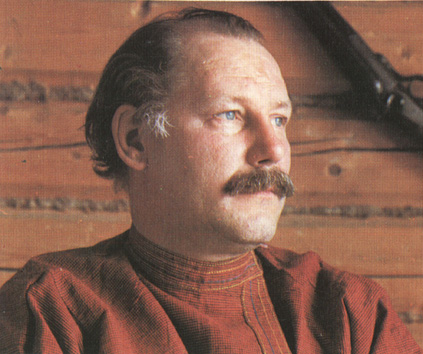

Vladimir

Stozharov

Vladimir

Stozharov

Today Russians are buying the artists they are familiar with from the Pushkin and Hermitage museums. Recent Russian acquisitions in New York and London have included outstanding paintings by Canaletto, Breughel, Cranach, Botticelli, Rubens and a particular favourite, Picasso. For example, in May 2006 an unidentified Russian walked into Sotheby’s in New York and bought Picasso’s seminal portrait of his muse, Dora Maar au chat, for $95m. The buyer reportedly outbid the 3 American billionaires, Paul Allen, Leslie Wexner and Steve Wynn. At various times the buyer has been believed to be Boris Ivanishvilli, Roustam Tariko and Alexander Abramov but none have confirmed it. Western dealers and auction houses are now scrambling over each other in their hurry to open Moscow offices to cater to this new clientele.

Buying the top paintings by the best Western artists is always a sound financial strategy but this requires deep pockets at today’s valuations; buying lesser examples by the famous artists must be avoided as those paintings only have a good value in a bull market. Examples of great paintings and their recent prices include Gustav Klimt’s Portrait of Adele Block Bauer, which was recently acquired by Ronald S. Lauder for $135m and Picasso’s Garçon a la Pipe, which made $104.1m at Sotheby’s in 2004. Van Gogh has sold for $82.5m, Renoir for $78m, and the late Lord Thomson bought Rubens’ Massacre of the Innocents for $76.7m at Sotheby’s in July 2002. In contrast, great examples of Russian art can be had for $5 m and sometimes with luck and hard work at under a million. Picasso is consistently the world’s most traded artist by volume although in 2007, at $319m he came in second to Warhol’s $420m and the only Russian artist in the top 10 was Mark Chagall at $78m. Either Western art is overvalued or the Russian art is undervalued and it is the opinion of this writer that Russian art is at the beginning of a bull market.

Russian collectors tend to concentrate on specific areas. The 19th century realist painters such as Isaac Levitan (world record price $3.25m), Ivan Shishkin ($1.42m) and Ilya Repin ($1.87m) are the equals of their European counterparts as can be seen by spending a morning in the Tretyakov Gallery in Moscow. The first quarter of the 20th century is dominated by the Russian Impressionists and the Avant-Garde movement. Leading Impressionists are Konstantin Korovin ($1.9m) and Petr Konchalovsky ($1.82m) and important Avant-Garde artists are, of course, Malevich ($17m), Goncharova ($9.78m) and Larionov ($4.5m). The prices of the works of the Russian Avant-Garde are more in line with Western prices because these artists for the most part escaped from Russia after the revolution and are thus better known in the West.

The first half of the Soviet period, 1918–1950, is dominated by the political subject matter demanded by Stalin. But when Stalin died in 1953, the “Khrushchev Thaw” allowed the development of the Moscow School and artists like the Tkachev brothers, Arkadi Plastov, Geli Korzhev, Vladimir Stozharov and Aleksei Gritsai. Interest in these artists is just beginning and good examples can still be found for under $500,000. As supplies of the earlier schools dry up interest will inevitably move to this period. Other areas developing are the Nonconformist Art of the later Soviet period and Russian contemporary art. Sotheby’s had its first dedicated sale of Nonconformist Art in February 2007 raising $5.17m selling 80% of the 113 lots. Russian contemporary art is evolving too fast to try and cover here but is rapidly developing a solid base of collectors.

Although new collectors are appearing at each sale, the market is still dominated by a few major buyers. Viktor Vekselberg, who controls the Renovo group with his partner, Leonid Blavatnik, buys through his $200m Aurora Fine Art Investment Fund and has been acquiring Repin, Konchalovsky, Aivazovsky and Vereschagin. When Sotheby’s planned to auction the Forbes collection of nine jewel-encrusted Fabergé eggs in April 2004, Vekselberg famously pre-empted the sale and bought them outright for $110m. Yelena Baturina, wife of Moscow’s mayor Yuri Luzkov, has a liking for Imperial porcelain and Pyotr Aven and Vladimir Semenikhin are both passionate collectors of Konchalovsky.

Recent developments have seen former president Putin taking an interest in the market and the emergence of some major players from former Eastern Europe. When the extensive collection of the late cellist Mstislav Rostropovich came up at Sotheby’s in September 2007, then president Putin reputedly encouraged Alisher Usmanov, Russia’s eighteenth richest man with a reported fortune of $6 billion (Forbes 2007), to buy it. The Russian Federal Cultural Agency then ‘encouraged’ Sotheby’s to let Usmanov pre-empt the sale with an $80m bid. Mikhail Shvydkoi, the head of Russia’s Federal Culture Agency, told reporters that the Russian government gave Sotheby’s guarantees that “the transaction would be in the interest of the Russian Federation” (and no doubt in Sotheby’s interest too). The collection of 45

0 items is now housed in the presidential palace in St Petersburg.

There is a collector in Slovenia (who doesn’t like to see his name in print) whose total art holdings, including Russian paintings, are now estimated to top the $1 billion mark. Vasil Bojkov, Bulgaria’s richest man and owner of TSK Sofia football team, collects Russian paintings but is better known for having 3,000 Bulgarian paintings and a collection of antiquities that is now believed to be the finest in the world, surpassing even that of the Ortiz Patino family of Switzerland.

In 2007 the art market posted its seventh consecutive year of price inflation with international art prices rising an average of 18% with a total turnover of around $9.6 billion, up 43.8% on 2006. 2007 will also be seen as the year that the Russian market came of age. A single Fabergé egg made $16m selling to a private Moscow museum, and Sotheby’s and Christie’s combined Russian sales totalled $324.9m with an annual growth of 45%, and, whilst still actively pursuing Russian art, Russian collectors emerged as a major force in the Western art market.